Kenya Budget: What’s Happening and How It Affects You

If you’ve been wondering why you see more road projects, new police training centres or changes to your paycheck, the answer lies in the latest Kenya budget. This year’s fiscal plan is a mix of big‑ticket spending on security, infrastructure and social services, plus some tweaks that will touch everyday wallets. Below we break down the main moves and give you easy ways to keep more cash in hand.

Key Highlights of This Year’s Budget

The government has earmarked a significant boost for the Directorate of Criminal Investigations (DCI). Interior Minister Murkomen announced new staff hires and a modern training academy, aiming to improve investigations across the country. That push will cost millions but is expected to create jobs and raise safety – something many Kenyans welcome.

On the revenue side, tax collection targets have been nudged higher. Expect stricter enforcement on import duties and a modest increase in value‑added tax for certain luxury items. The extra cash will fund the new highways and rail upgrades that are already under construction.

Social spending also got a lift. Health clinics in rural counties will receive more equipment, while education budgets now include a line item for digital learning tools. If you have kids at school or rely on local health services, these changes should show up as better facilities within the next two years.

Smart Ways to Stretch Your Money in Kenya

While the budget rolls out, there are simple steps you can take to protect your pocket. First, keep an eye on VAT changes – shop for essentials at stores that still offer exemptions or lower rates. Second, use mobile money platforms that often give cash‑back rewards on everyday purchases; they’re a quick way to shave off a few percent.

Traveling inside Kenya? The new road projects mean faster routes, but tolls may rise. Consider using public transport for short hops and reserve car hires for longer trips when you need flexibility. Booking accommodation early can lock in lower rates before peak season hikes.

If you’re looking to invest, the budget’s focus on security and infrastructure signals potential growth in construction‑related stocks or bonds. A modest allocation toward these sectors could pay off as projects finish and generate revenue.

Lastly, stay informed. Sign up for alerts from the Kenya Revenue Authority or local news hubs like Kroonstad News Hub. Knowing when a new tax rule kicks in lets you adjust your budget before it hits your bank account.

Bottom line: the Kenya budget is shaping roads, safety and services while nudging taxes upward. By tracking these moves and tweaking how you spend, you can stay ahead of the curve and keep more money where you need it.

Kenya's Budget Process Explained: Key Timelines and the Role of the Finance Bill 2024

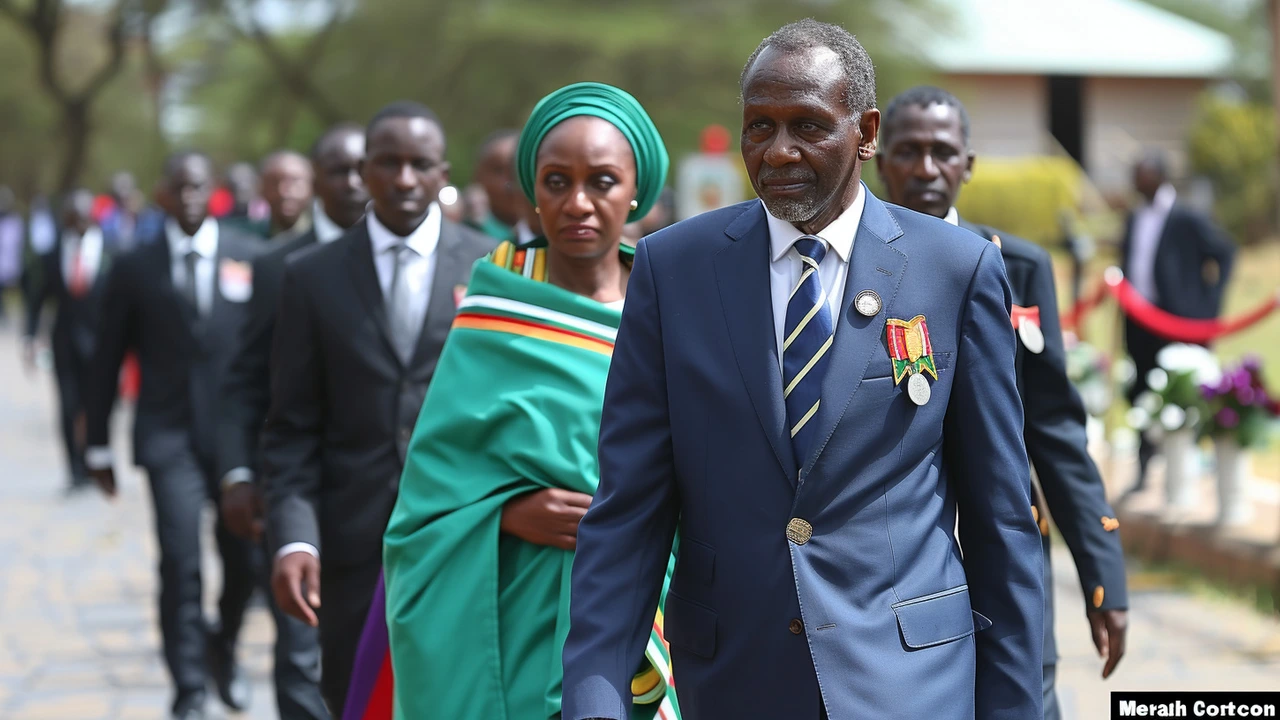

Cabinet Secretary Njuguna Ndung'u is set to present Kenya's National Budget Policy Statement for 2024/25 before Parliament approves the Finance Bill 2024. This process is guided by national and international regulations, ensuring transparency and accountability.

read more