Understanding Kenya’s Budget Presentation and Approval Process for 2024/25

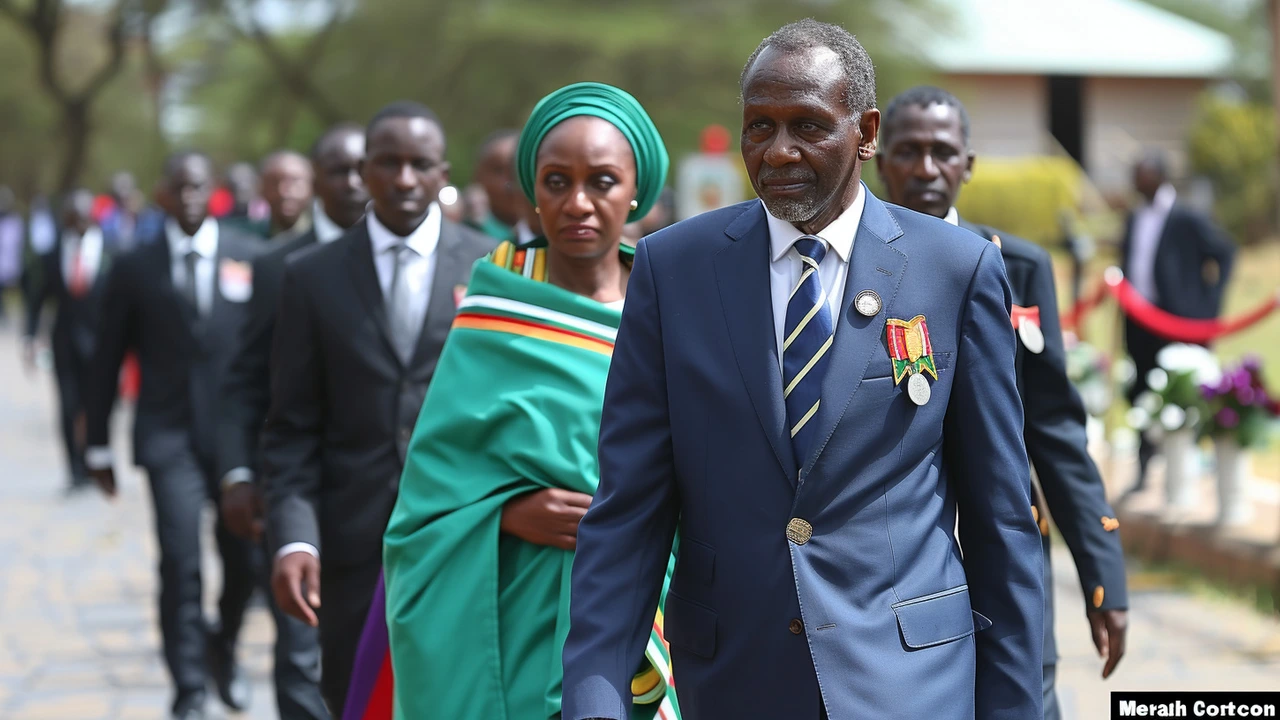

In Kenya, the budget-making process is a critical and structured exercise, governed by both national legislation and international obligations. This year, the task falls on Treasury Cabinet Secretary Njuguna Ndung'u, who is set to present the National Budget Policy Statement for the 2024/25 financial year on June 13. This event is particularly significant because it will occur before the approval of the Finance Bill 2024 by Parliament, a procedure necessitated by multiple legal and regulatory requirements.

The National Budget Policy Statement: What It Entails

The National Budget Policy Statement is a comprehensive document that outlines the government’s financial and economic objectives for the upcoming fiscal year. It lays the groundwork for the allocation of public resources, outlining both revenue generation strategies and expenditure plans. By presenting this document, the government provides transparency and sets the stage for informed debate among policymakers, stakeholders, and the public. This year’s statement will include strategies tailored to achieve Kenya’s economic goals amidst a dynamic global economic environment.

Timing and Legal Requirements

The timing of this budget presentation is intricately linked to legal and international commitments. According to the East African Community (EAC) Treaty, finance ministers from the partner states are required to present their budgets simultaneously. This synchronisation underlines the regional coherence in economic planning and policy coordination. The synchronised reading ensures that each member state is aligned in their fiscal strategies, fostering regional economic stability and mutual economic growth.

The Role of the Finance Bill 2024

The Finance Bill 2024 is a critical document embedded in Kenya’s budget process. It outlines various fiscal policies, taxation measures, revenue generation strategies, and amendments to existing tax laws. Essentially, the Finance Bill serves as the legal framework necessary for the implementation of the financial proposals introduced in the National Budget Policy Statement. Without the passage of the Finance Bill, the proposed budgetary allocations and tax measures would lack the legal basis needed for execution.

Parliamentary Scrutiny and Public Participation

Once presented, the National Assembly Finance and Planning Committee will review the Finance Bill 2024. The scrutiny involves meticulous examination of proposed revenue measures and their potential impacts on various sectors of the economy. The committee’s analysis is crucial as it ensures that the proposed measures are fair, adequate, and likely to achieve the intended economic outcomes. After their review, the committee is expected to present their findings to the house next week, facilitating further parliamentary debate and approval processes.

Public participation is another essential aspect of Kenya’s budget-making process. According to the Public Finance Management Act of 2012 and the Constitution of Kenya of 2010, budget proposals must be publicised. This transparency allows citizens to provide input, thus fostering democratic accountability. By incorporating public feedback, the government ensures that the budget reflects the populace’s concerns and developmental priorities.

Key Timelines in the Budget Process

The budget-making process adheres to a stringent timeline. By April 30, budget estimates are submitted. From there, they undergo review by Parliament, which includes detailed examinations by relevant committees. These budget estimates are publicised to ensure transparency and enable public debate. The finalisation and approval of the budget and the Finance Bill are expected to be completed by June 30, meeting the legal deadline. Adhering to these timelines is essential for uninterrupted government operations and the timely implementation of development projects.

Fiscal Policies and Revenue Generation Strategies

The Finance Bill 2024 will detail various fiscal policies designed to stimulate economic growth and ensure sustainable revenue generation. These policies are aimed at broadening the tax base, improving tax compliance, and enhancing the efficiency of revenue collection mechanisms. Measures are also likely to include adjustments to existing tax rates, introduction of new taxes, and amendments to tax laws to close loopholes and curb tax evasion.

Expenditure Plans: Allocation of Resources

The allocation of public resources is a critical aspect of the budget policy statement. The government is expected to prioritise sectors that drive economic growth and social development. Key sectors likely to receive significant attention include education, healthcare, infrastructure, and social protection. These sectors are vital for enhancing the quality of life for Kenyans and fostering long-term sustainable development.

In the education sector, for example, the government may allocate funds to improve infrastructure, increase teacher salaries, and provide learning materials. In healthcare, focus could be on expanding access to medical services, building and equipping hospitals, and addressing critical issues like maternal and child health. Infrastructure development might see investments in roads, railways, and energy projects, all aimed at boosting economic activities and regional integration.

Sustainable Development and Environmental Considerations

An evolving focus in recent budgets has been the integration of sustainable development goals (SDGs) and environmental considerations. These include initiatives to combat climate change, promote renewable energy, and ensure sustainable use of natural resources. The National Budget Policy Statement for 2024/25 is expected to align with these global objectives, underlining Kenya’s commitment to environmental sustainability and resilience against climate-related challenges.

Strategies could encompass support for green technologies, reforestation projects, and policies aimed at reducing carbon emissions. Such measures not only address environmental concerns but also open avenues for new economic opportunities in green industries.

Challenges and Opportunities

Several challenges can impact the successful implementation of the national budget. These include potential revenue shortfalls, economic disruptions, and unforeseen expenditures, especially in light of the global economic uncertainties. However, these challenges also present opportunities for policy innovation and efficiency improvements. Strong fiscal management, prudent spending, and robust economic policies are essential to navigate these hurdles.

Furthermore, the collaborative approach involving multiple stakeholders—parliamentarians, government agencies, civil society, and the public—provides a resilient framework for budget implementation. This inclusive process ensures broad-based support and accountability, which are critical for economic stability and growth.

Conclusion

The presentation of Kenya’s National Budget Policy Statement and the subsequent approval of the Finance Bill 2024 are foundational steps in the country’s fiscal planning. These processes, governed by national and international frameworks, ensure transparency, accountability, and strategic allocation of resources. By understanding and participating in the budget-making process, Kenyans can contribute to shaping policies that drive inclusive economic growth and development.

As we approach the budget presentation on June 13, it's essential to stay informed and engaged in the discussions that will shape Kenya’s economic future. The decisions made in these weeks will have profound implications on the livelihoods of millions and the trajectory of the nation’s development.

Honestly? I just want to know if my phone bill is gonna go up again. 🙄

This is all a distraction. The real budget is being written in Geneva and Brussels - Kenya’s just signing the papers. 🤫

The Finance Bill 2024? I’ve seen this movie before. Every year, they promise growth, then raise fuel taxes, and we all just... keep driving. 😅

i hope they actually listen to the people this time... like, realy listen... not just for the photo ops 🙏

WHY DO THEY ALWAYS TAX FOOD?!?!?!?!?!?!?!?!? I CAN’T EVEN BUY SUGAR NOW 😭

The East African Community’s synchronized budgeting is a strategic masterstroke. Kenya’s adherence to regional fiscal discipline demonstrates a commendable commitment to multilateral governance, especially when contrasted with the fiscal irresponsibility exhibited by certain neighboring states. This is not mere procedure-it is statecraft.

It's interesting how the budget process balances legal formality with public engagement. The PFM Act and Constitution create a framework where transparency isn’t optional-it’s foundational. But I wonder: how many citizens actually understand the Finance Bill’s technical clauses? Maybe the real challenge isn’t passage, but comprehension.

The Finance Bill 2024, as presented, contains multiple ambiguities: Section 12.3 regarding capital gains taxation is not clearly aligned with Section 8.1 of the Income Tax Act (Cap. 470), and the definition of ‘green technology’ in Schedule 5 lacks regulatory clarity-this could lead to litigation, administrative confusion, and potential revenue leakage if not corrected before enactment.

The people need to be part of this not just as spectators but as co-creators. Budgets aren’t just numbers-they’re promises to families, farmers, and students. If we don’t make it personal, we lose the point.

They’ll pass it. Then raise prices. Then blame inflation.