Fiscal Policies – Simple Guide

Ever wonder why your tax bill changes or why the government builds a new road? Those moves are part of fiscal policy. It’s the way governments decide how much to spend, what taxes to collect, and how to balance the books. In plain terms, fiscal policy is the money toolbox that shapes jobs, prices, and growth.

When a country faces a slowdown, officials can pump more cash into the economy by spending on projects or cutting taxes. That extra money puts people back to work, boosts demand for goods, and can lift confidence. On the flip side, if inflation is heating up, they might raise taxes or slash spending to cool things down.

Why Fiscal Policy Matters

The choices made in fiscal policy touch everyday life. A new school built in your town means jobs for construction workers and better education for kids. Lower income‑tax rates can leave more money in a family’s pocket, while higher taxes fund health care or social safety nets.

Fiscal policy also signals to businesses how stable the economy is. Predictable tax rules help companies plan investments, hire staff, and set prices. When the government runs a big deficit—spending more than it collects—it can borrow money, which may raise interest rates later on. That ripple effect influences mortgage costs, car loans, and even your credit‑card bills.

Key Tools of Fiscal Policy

The two main levers are government spending and taxation. Spending includes everything from building highways to funding research or paying public sector salaries. Taxation covers income tax, corporate tax, sales tax, and special levies on things like cigarettes.

Another tool is the budget surplus or deficit. A surplus means the government collects more than it spends; a deficit means it borrows to cover the gap. Running a deficit isn’t always bad—many economies use it to jump‑start growth during recessions. The key is timing and scale.

Automatic stabilizers are built‑in features that soften economic swings without new laws. For example, unemployment benefits rise when jobs disappear, automatically putting money into people’s hands. Likewise, progressive tax systems collect more from higher earners when incomes grow, helping to cool an overheating economy.

Fiscal policy decisions often spark debate. Some argue for lower taxes and minimal spending to let the private sector drive growth. Others push for higher public investment in health, education, and infrastructure to address inequality and long‑term competitiveness. The balance depends on a country’s goals, debt level, and political climate.

In practice, fiscal policy works alongside monetary policy—the central bank’s control of interest rates and money supply. While the central bank adjusts borrowing costs, the government tweaks spending and taxes. When both work together, they can steer the economy more effectively.

So next time you hear about a new tax plan or a big infrastructure bill, remember it’s part of fiscal policy at work. These choices aim to keep jobs stable, prices steady, and public services running. Understanding the basics helps you see how government actions impact your wallet and community every day.

Kenya's Budget Process Explained: Key Timelines and the Role of the Finance Bill 2024

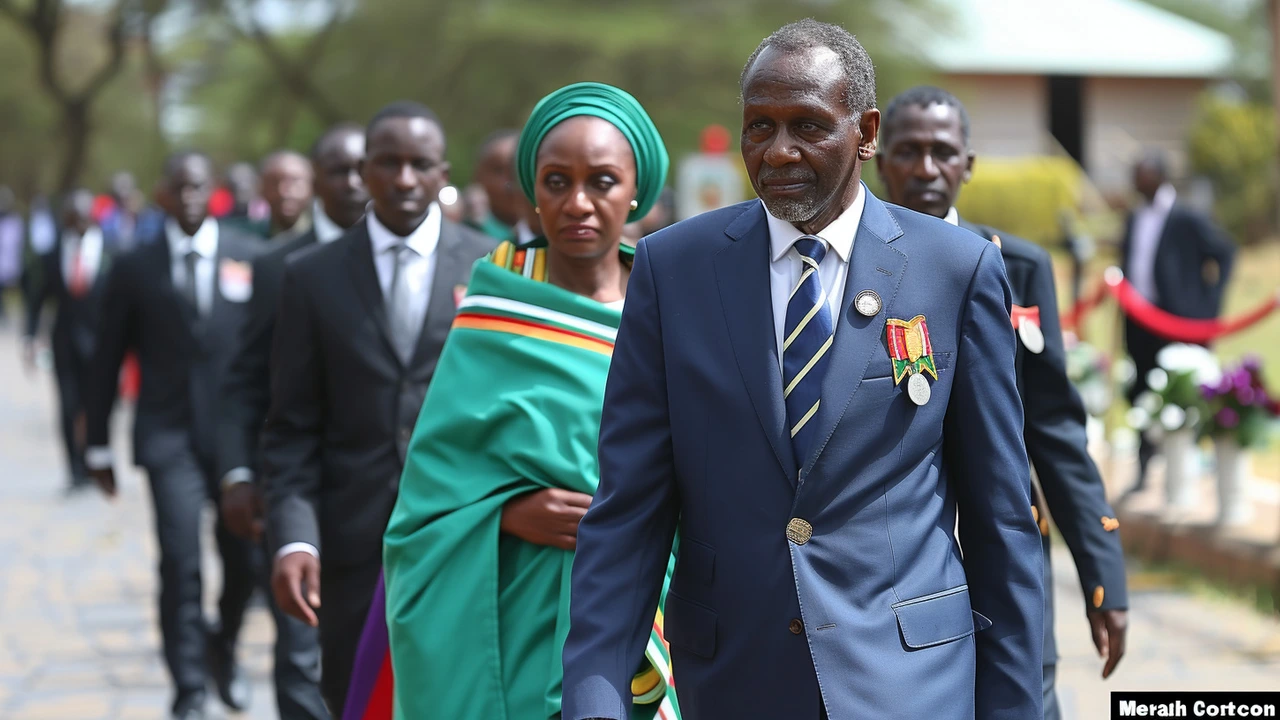

Cabinet Secretary Njuguna Ndung'u is set to present Kenya's National Budget Policy Statement for 2024/25 before Parliament approves the Finance Bill 2024. This process is guided by national and international regulations, ensuring transparency and accountability.

read more