Finance Bill 2024 Explained – What It Means for You

The Finance Bill 2024 just landed, and you’re probably wondering what’s new and why it matters. In plain English, this bill is the government’s tool to turn the budget into law. It sets tax rates, decides where money goes, and tweaks rules that affect your paycheck, your shopping list, and even your business plans.

We’ll break down the biggest changes in two quick sections so you can see how they hit home. No jargon, just the facts you need to make sense of the numbers on your next tax return.

Major Tax Changes

First up: taxes. The Finance Bill keeps the personal income‑tax brackets largely the same but nudges a few thresholds. If you earn under R250,000 a year, your marginal rate stays at 18%. Earn between R250,001 and R500,000? You’re still looking at 26% – no surprise there.

The real shift is for higher earners. The top bracket (above R1.5 million) jumps from 45% to 46%. It’s a modest rise, but it adds up across the nation’s wealthiest taxpayers and helps fund new social programs.

VAT is another hot spot. The bill leaves the standard 15% rate untouched but re‑introduces a temporary reduced rate of 12% on basic food items for six months to ease cost‑of‑living pressure. Keep an eye on receipts – you’ll see that lower rate reflected soon.

Corporate tax sees a tiny tweak: the base rate drops from 27% to 26.5% for companies with annual turnover under R500 million. The aim is to boost small and medium enterprises, so if you run a business, this could mean a bit more cash flow.

Spending Shifts & New Programs

The other side of the bill is where the government says what it will spend on. Health gets a noticeable bump – R30 billion extra for primary care clinics and a new rollout of community health workers in rural areas. If you’ve visited a clinic recently, expect shorter wait times.

Education also sees a boost. There’s an additional R20 billion earmarked for upgrading school infrastructure, especially in under‑served townships. That means more laptops, better labs, and some new classrooms in the next couple of years.

Infrastructure projects get a big slice too: $2 billion (about R38 billion) is set aside for road repairs on major highways and expanding fiber‑optic broadband to remote regions. If you live outside the city, better internet could be just around the corner.

Finally, the bill introduces a new “Green Incentive Fund” with R5 billion to support solar installations for households and small businesses. The government will offer tax credits for qualifying projects, so keep your receipts if you go green.

All these moves are aimed at balancing the budget while trying to lift living standards. It’s a delicate dance – higher taxes on the rich, targeted relief for everyday folks, and strategic spending on health, education, and infrastructure.

Bottom line: the Finance Bill 2024 changes a few tax rates you’ll see on your next payslip, offers short‑term relief on essential goods, and promises new money for services that matter to most South Africans. Stay tuned to local news and check the Revenue Service website for detailed tables – they’ll help you plan ahead whether you’re filing taxes, budgeting household expenses, or running a business.

Kenya's Budget Process Explained: Key Timelines and the Role of the Finance Bill 2024

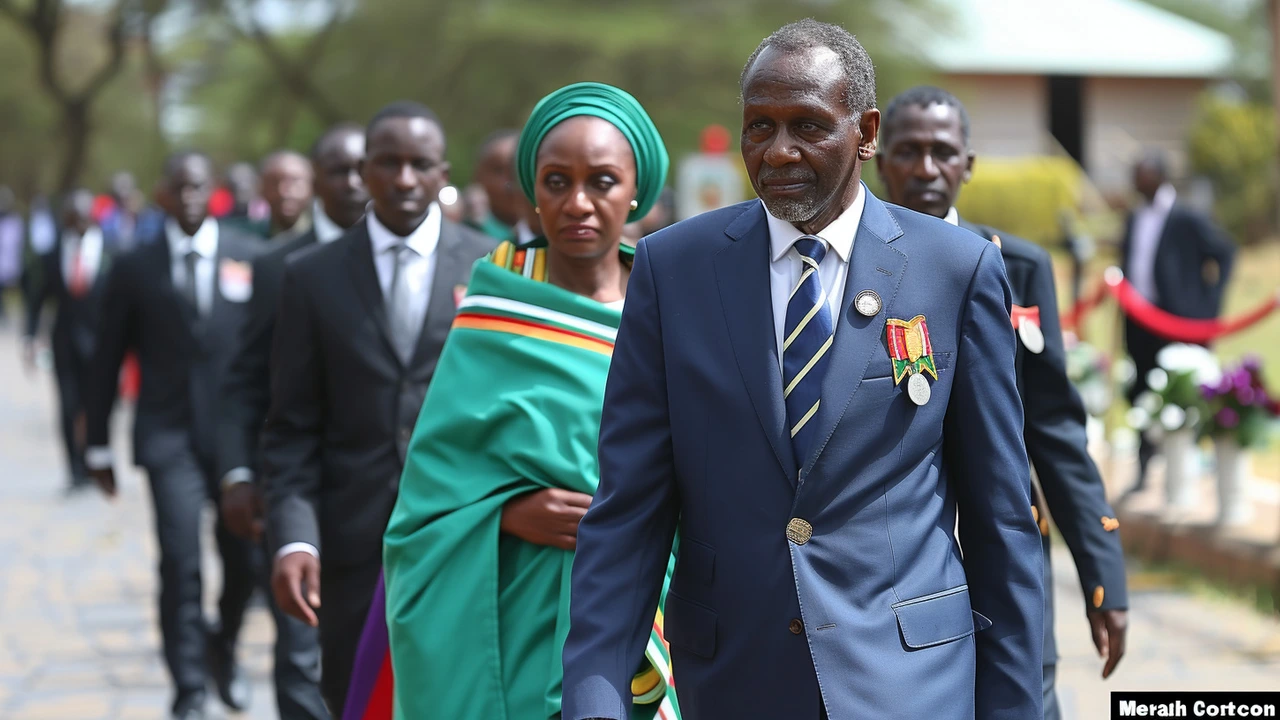

Cabinet Secretary Njuguna Ndung'u is set to present Kenya's National Budget Policy Statement for 2024/25 before Parliament approves the Finance Bill 2024. This process is guided by national and international regulations, ensuring transparency and accountability.

read more